car insurance georgia Smoking laws in atlanta Insurance georgia car note final

Car Insurance in Georgia: Unraveling Smoking Laws and Insurance Implications

Navigating Georgia's Smoking Laws: A Comprehensive Guide

Georgia's smoking laws, like those in many states, aim to protect public health and reduce secondhand smoke exposure. These regulations have significant implications for car insurance policies and premiums. Understanding the interplay between smoking laws and car insurance in Georgia is essential for both drivers and insurance providers.

1. Smoking and Car Insurance Premiums: The Correlation

Auto insurance companies in Georgia consider smoking habits when determining insurance rates. This is because smoking is often associated with increased health risks, which can lead to higher medical expenses in the event of an accident. Consequently, smokers may face higher car insurance premiums compared to non-smokers.

2. Truth-in-Rating Laws: Transparency in Insurance Pricing

Georgia follows truth-in-rating laws, which require insurance companies to disclose how various factors, including smoking status, affect insurance premiums. This transparency allows consumers to make informed decisions about their coverage and compare rates from different providers. It also prohibits insurers from unfairly discriminating against smokers.

3. Anti-Discrimination Laws: Ensuring Fair Treatment

Georgia's anti-discrimination laws protect individuals from being denied car insurance coverage or charged higher premiums solely based on their smoking status. These laws prevent insurance companies from engaging in unfair practices that could lead to discrimination against smokers.

Car Insurance Options for Smokers in Georgia

Despite the potential for higher premiums, smokers in Georgia still have options for obtaining car insurance coverage.

1. Exploring Standard Car Insurance Policies

Most car insurance providers in Georgia offer standard policies that include coverage for smokers. However, smokers can expect to pay higher premiums compared to non-smokers.

2. Seeking Specialized Insurance Programs

Some insurance companies may offer specialized programs designed for smokers. These programs typically involve tailored coverage options and customized rates that take into account an individual's smoking status.

3. Comparing Quotes from Multiple Providers

It is crucial for smokers to shop around and compare quotes from several insurance providers. This allows them to identify carriers that offer competitive rates for smokers and choose the policy that best suits their needs and budget.

Additional Factors Influencing Car Insurance Rates

Aside from smoking habits, several other factors can impact car insurance premiums in Georgia:

- Age: Younger drivers generally face higher premiums due to their perceived higher risk of accidents.

- Driving History: A record of traffic violations, accidents, or DUI convictions can lead to increased premiums.

- Vehicle Type: Sports cars and luxury vehicles often come with higher premiums compared to more economical models.

- Location: Drivers living in urban areas with higher accident rates may pay more for car insurance.

- Coverage Level: Selecting higher coverage limits and additional coverage options can result in higher premiums.

Conclusion: Striking a Balance

While smoking can impact car insurance rates in Georgia, smokers can still obtain coverage through standard or specialized insurance policies. By understanding the state's smoking laws and insurance regulations, smokers can make informed decisions about their coverage and compare rates from multiple providers to find the most suitable and affordable car insurance option.

If you are searching about Georgia driving laws - Atlanta Insurance you've visit to the right place. We have 10 Pics about Georgia driving laws - Atlanta Insurance like Car Insurance Rates in Georgia - Atlanta Insurance, Georgia Car Insurance Laws - Blasingame, Burch, Garrard & Ashley, P.C. and also Did Your Georgia Car Insurance Lapse? | Southern Harvest. Here it is:

Georgia Driving Laws - Atlanta Insurance

atlantainsurance.com

atlantainsurance.com laws driving georgia insurance agent car

Does Georgia Car Insurance Cover Other Drivers? | Bader Scott

baderscott.com

baderscott.com Georgia Car Insurance | American Insurance

www.americaninsurance.com

www.americaninsurance.com insurance georgia car note final

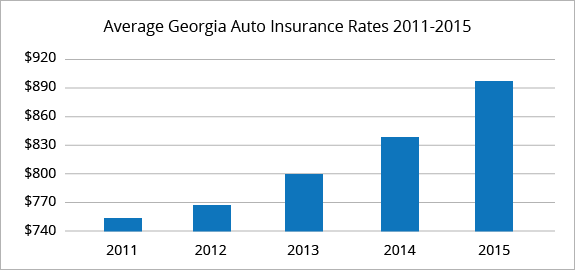

Average Car Insurance Rates In Georgia - Rating Walls

ratingwalls.blogspot.com

ratingwalls.blogspot.com quotewizard

Find Cheap Car Insurance Georgia | Insurance Geek

www.insurancegeek.com

www.insurancegeek.com Best Car Insurance In Georgia: Top Companies In 2023

www.marketwatch.com

www.marketwatch.com Georgia Car Insurance Laws - Blasingame, Burch, Garrard & Ashley, P.C.

www.bbga.com

www.bbga.com insurance car laws georgia

Did Your Georgia Car Insurance Lapse? | Southern Harvest

www.southernharvestinsurance.com

www.southernharvestinsurance.com Car Insurance In Georgia For 2020

www.general.com

www.general.com car basics

Car Insurance Rates In Georgia - Atlanta Insurance

atlantainsurance.com

atlantainsurance.com Find cheap car insurance georgia. Average car insurance rates in georgia. Best car insurance in georgia: top companies in 2023